Money is Emotional: How to Understand Your Relationship with Money Through Financial Coaching with the Founder of Bolder Money

Update: I recently launched my newsletter, The Sheconomist, and would love for you to subscribe: sheconomist.com - I share so many tools and resources that help young, high-achieving women with radical money and career self-advocacy.

-----

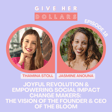

This week we dive into the world of financial coaching with Amy Schultz, Co-founder of Bolder Money.

Amy's own struggles with debt despite being financially literate, underscore the importance of understanding our emotional relationship with money. Through her own transformative experience with money coaching, Amy recognized a gap in the market. Bolder Money was born from her desire to provide accessible financial coaching that addresses the emotional side of money management.

We also talk about what it's been like to start and operate company with a male Co-founder after realizing that the myth of the solitary, struggling entrepreneur was hindering Amy's progress.

Amy's journey is not just about numbers; it's about breaking free from the emotional constraints that often accompany our personal finances, especially for women.